When you’re mapping your market with a format study, hoping to find a competitive gap, considering these principles may help you succeed.

Our guest author Stephen Ryan is managing director of Ryan Research, a UK-based radio programming & research consultancy. Here, in the latest in a series of articles on music research, he talks about conducting a format study for your radio market. This first parts looks at how to approach a format study effectively.

Developing the music proposition

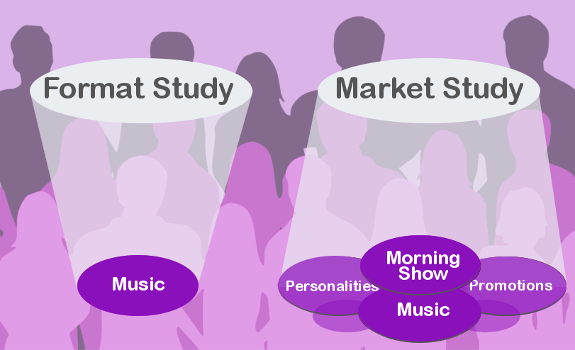

This differentiates a focused format study from a broader market study (image: Ryan Research)

Choose your programming approach

In a developing radio market, the initial entrants will have an open field to play with. These trailblazers tend to focus on broader appeal formats such as CHR and AC. If the range of competition remains limited for a reasonable period of time, it allows these early entrants to create a strong heritage and loyalty.

A new station needs to decide whether it is strategically possible to go head to head with heritage players or whether it should provide a different or unique proposition. If this new entrant has access to sufficient funds to market heavily, and has the benefit of a greater strategic sophistication using research to fine-tune the proposition, then it may be able to take the heritage player or players head on, and win. However, given time as the market develops, the main players tend to become more sophisticated in strategically developing their format and proposition.

Map your market strategically

For anyone considering to enter a more developed and competitive market, it may be more and more difficult to find a so-called ‘hole in the market’. Unless you have the resources and finances to attack the heritage players, you need to identify a gap where you can effectively launch a new station. This is where a format study (sometimes named ‘mapping study’) comes into play.

The terms ‘format study’ and ‘market study’ are sometimes used interchangeably. While there are similarities, format studies tend to focus on developing the music proposition for a station. Market studies tend to have a broader remit; looking not just at music, but also at other key elements of your proposition such as personalities, morning shows, features and promotions. For this set of articles, we focus on music testing, thus speaking about a ‘format study’.

Understand your format clusters

While the more mainstream formats have the advantage of attracting a large range of listenership, the ability provides both a strength and a weakness. Their strength is the broad appeal, but at the same time, their broadness means that they have more difficulty protecting and maintaining ownership of all sub-genres that make up their product or format. The use of a format study can help identify the appeal of the sub-genres, and whether the ownership of the genres with sufficient appeal is strong or weak for the existing players.

A format study is not the exclusive preserve of the new entrant. It is also a strategic tool for existing players in the market. Stations may wish to broaden or tighten their formats, or indeed totally flip a format. As we will see, a format study doesn’t just highlight the strength or weakness of individual music styles and genre types, but also how compatible each genre is with all the other genres tested. This allows you to see how the various music styles fit with each other.

Keep your target focus tight

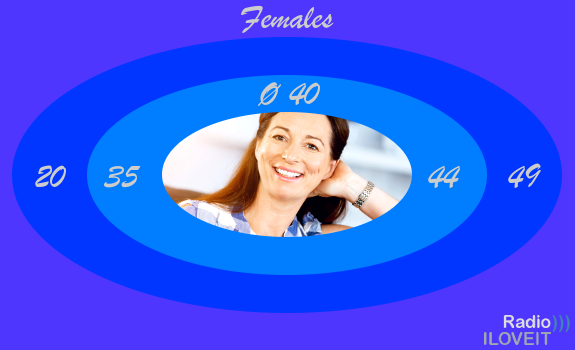

When you’re launching a new station against an established competitor with a broad target (e.g. females 20-49), you could focus on a certain segment (e.g. females 35-44), when your research indicates it’s a market gap with good potential (image: Thomas Giger, 123RF / Sergey Nivens)

Broaden your format research

The approach to the format study depends on your strategic aims. If you wish to investigate the market as a whole (as you have don’t have a predisposition to a particular format type), then you would need to test enough music styles to have a total representation of all the main station formats available to listeners in the existing market. You may also want to include music styles that are not currently heard in the market, but that you feel may prove to have a sufficient appeal. This approach will give you the broadest insight into the existing market.

However, it can prove to be an expensive piece of research. The survey may take 20 minutes or more per respondent, hence the fieldwork costs will be high. If you are using a consultant, the fee will also be higher due to the complexity of analysing and cross-comparing a large number of styles. A wide age spread will also be required, which means that a large sample will need to be recruited.

Meet your competition focused

Depending on how deep you will want to go in the analysis, every gender- and age-based cross tab will need to have a minimum of 30 people in it. As we have shown in previous articles, the bigger the sample; the more expensive the fieldwork. Ideally, each sub-age group in the sample should have a 5-year span (e.g. 15-19, 20-24, and so on).

However, if you are conducting a study on the full market (like 15-54), and if cost is a concern, then each sub-age group could be broadened to a 10-year spread. Before making that decision, keep in mind that when you’re launching a new radio station against strong existing competition, you should keep your target focus tight. You can consider widening your approach after you have established yourself.

Limit your session duration

If you wish to develop your music format based on a set of sub-genres of an existing broader format, then you can potentially reduce the number of styles to test. You can also focus the sample required to concentrate on those potential listeners the format would most appeal to. For example, if an existing Soft AC in the market has a broad genre mix from the 70’s through to today, there may be an opportunity to focus in on a narrower set of eras and drive it solely through females. The first key step is choosing the song hooks that will represent each of the styles to be tested.

Normally, each music style comprises 3 song hooks that are each 7-9 seconds long. You could include 4 hooks, but keep in mind that this will impact the duration of each music style, making the survey longer (thus more expensive). If we have an average hook length of 8 seconds, each music style takes 24 seconds. If you are testing 18 music styles, that’s already 7.5 minutes of audio. Using 4 hooks will add another 2 minutes, so you might want to keep it to 3 hooks per style.

You conduct what is basically a mini-AMT

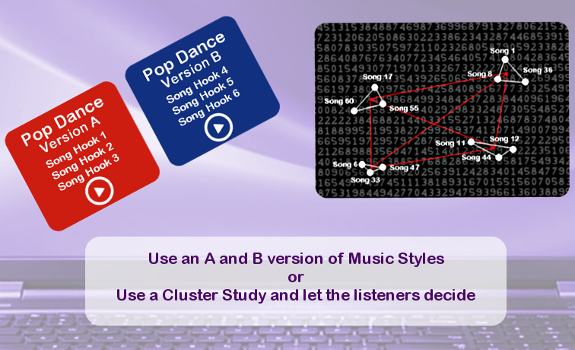

You can either define your market’s key music styles yourself, or let your target audience cluster them for you through some kind of (auditorium) music test (image: Ryan Research)

Select your hooks carefully

There are two main approaches to deciding what music styles to test and which song hooks to use. The first is based on your (or your consultant’s) music programming experience. Here you need to monitor the existing stations in the market and identify the key music styles that listeners are exposed to on a regular basis. Once you have a list of the key music styles, you then need to identify the song hooks you are going to use to demonstrate each of them.

Selecting the hooks is always a delicate balance. You want to choose familiar & popular songs, which can be based on the amount of airplay and the number of record sales/downloads. If a song has been played a lot in the market, it can be assumed it has had an enduring appeal. You may also want to review current Top 40 charts, or legitimate past charts.

Increase your research reliability

Avoid mixing mega hits with weaker songs, as that one hit may skew the result. Remember, the respondent is being asked to rate a style; not the individual songs. You will also want to have an A and B version of each music style, where 50% of the sample will hear version A and the other 50% will hear version B. This dilutes the chance of a particular song skewing the results for an individual style. For example, once you have put together the 3 song hooks for ‘music style 1’, that becomes the A version. You then identify 3 more song hooks that can represent the same ‘music style 1’ that becomes version B.

The other method for selecting songs for each style is more scientific, and requires an additional piece of research prior to the format study being conducted. This involves a cluster study. There are mixed views amongst consultants about the efficiency and benefit of conducting a cluster study. It is, of course, an additional expense. You can use them in certain circumstances, where they can prove their worth. There is an example of this later in the article.

Define your clusters carefully

How we as radio programmers split music styles into separate music genres may not necessarily be how our listeners perceive or understand them. A cluster study allows your audience to choose how music genres are defined. In this type of study, you conduct what is basically a mini-AMT (auditorium music test) with a list of 70 to 80 songs, representing the various music styles heard in the market. The difference here is that each of the songs in the list is rated individually by the respondent, rather than styles.

The analysis conducted after the fieldwork is completed, is quite sophisticated, so you may require the services of a consultant. Clustering techniques such as the Euclidean method are used to take the ratings for each song, and then cross-reference them to all the other songs. The result is the formation of clusters, where the songs contained therein fit the closest together. The clusters are then labelled as the music styles to be tested in the format study.

Combining music styles should be approached with extreme care

Some music styles work better for you as a stand-alone music style, illustrated by a huge diversity of 90s Pop: from power ballads & teen pop to techno/house & modern rock (image: Thomas Giger)

Discover your station’s USP

A cluster study has the benefit of showing you how the listener views the music heard in the market. Let’s say you wish to decide what music styles to test, and you’re in a market where, as well as international hits, there are local versions of the various styles produced by indigenous artists. Looking at 90s Pop, do you have to have a 90s International Pop style and a 90s Local Pop style, or can you combine both into one? If 90s International Pop songs cluster well with 90s Local Pop, you could consider combining them. (As far as the listener is concerned, they’ll fit under the same umbrella.)

However, combining music styles should be approached with extreme care. You could accidentally remove or dilute a key music style, which should have been left as a standalone style. By doing so, an opportunity to find an elusive gap in the market may be missed. If you are using music styles that were defined by using a cluster study, you do not need A & B versions. In the next part, we’ll look at the analysis side of a format study, and what you should be looking for from the results depending on your strategic goals.

Header image: Ryan Research

Add Your Comment