A Radio))) ILOVEIT First: universal takeaways for radio broadcasters from a new report on audio consumption. Where are we heading, and how should we anticipate?

Toronto-based research company Audience Insights and Canadian commercial radio advocate Radio Connects have just completed a visual presentation of Radio on the Move, a sales tool for radio stations to position themselves as a relevant platform. We spoke with researcher Jeff Vidler about lessons for programmers from the study, which hasn’t been released to the public yet, including: how to seize the opportunity of connected cars and smart speakers.

‘Radio commercials can support online marketing’

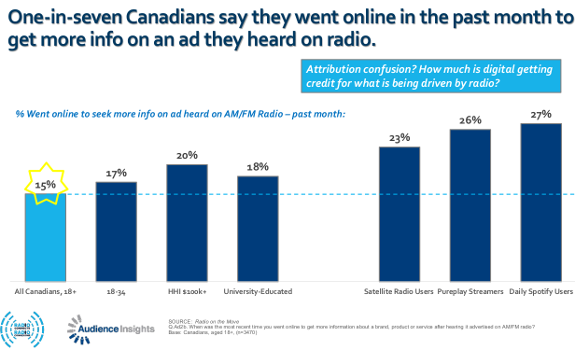

Even satellite, pureplay and Spotify fans deliver a high AM/FM-radio-to-online conversion when they do listen to broadcast radio: click to enlarge (image: Audience Insights, Radio Connects)

Underline your massive reach

In Canada, pureplay (online-only) music streaming has shown dramatic growth, while music sales continue to decline as people want to hear their favourite songs on demand. Spotify is Canada’s most popular pureplay service and twice as big as Apple Music, which takes the second place. One in six Canadians listen to Spotify at least once a week; one in ten listen daily, while the service was launched there late (in 2014, along with Apple Music and Google Play Premium). “Canada has its own royalty regime, and it’s not that big of a market, so it wasn’t first on anyone’s list”, Jeff Vidler clarifies.

Putting Spotify’s popularity (especially among 18-34 year-olds, who tend to hear a bit less broadcast radio than older age groups) into a pro-radio context, the writers point out that ‘AM/FM radio still has a big lead over all Spotify for daily listening across all demos’. One third of all Spotify listeners in Canada pay for its ad-free service. The report states that ‘people that subscribe to Spotify are more affluent and educated, a target that Spotify ads do not reach’, and ‘half of Spotify’s power users access an ad free subscription — that lies beyond the reach of advertising’.

Make your service impeccable

“I didn’t get to see any significant direct evidence that streaming displaces listening to radio”, Vidler says. “It displaces listening to personal music; iPod and iTunes, which in turn displaces CDs and cassettes. Just because a lot of people are streaming doesn’t mean they don’t want to listen to radio.” Even among those who like online-based music services, radio remains to be popular in Canada: ’close to 90% of pureplay music streamers still listen to AM/FM radio daily’.

The number 1 reason for AM/FM loyalty is that stations offer news and information, and connect listeners to what’s happening in general. It’s remarkable that, while there are mobile apps offering the same, 55-56% of Canadian pureplay streamers still tune in to broadcast radio for practical info like news, weather & traffic. And focus groups indicate that a good traffic service can still connect radio to people who spend a lot of time in the car, especially on weekdays:

Push your online conversion

More about in-car listening in a minute, but first more on radio and digital, like how radio commercials can support online marketing. It makes sense to mention an easy-to-remember website URL in a radio spot, as Radio on the Move illustrates radio’s potential drive to digital. One in seven Canadians say they went online in the past month to find more information about a spot on AM/FM radio that caught their attention. Especially young adults, university-educated people and high-income earners (between 17% and 20% of these groups) are doing this.

The report speaks of a possible ‘attribution confusion’ (asking: ‘how much is digital getting credit for what is being driven by radio?’) by showing that — when they do listen to AM/FM radio — users of satellite radio, pureplay streaming and free, ad-supported Spotify are also going online quite often to find details about a radio ad message that resonates with them. Even if these people may be hardcore satellite, pureplay or Spotify listeners, their AM/FM-radio-to-online conversions are between 23 and 27%, which leaves an impression that radio campaigns can be very effective.

‘Car drivers seem to highly appreciate radio’

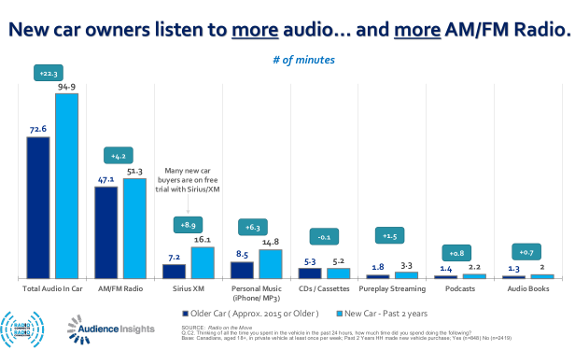

Apart from generating high AM/FM radio in-car listening shares, 6 in 10 Canadian adults want to have an AM/FM radio in their new car: click to enlarge (image: Audience Insights, Radio Connects)

Improve your drive-time hours

You may want to invest in both your morning show and your afternoon drive. The Canadian automobile industry has recovered between 2010 and 2017, showing a near 5% growth over the last year to over 2 million light car sales a year. That’s great news for radio; the number 1 medium for in-car listening for 61% of all Canadians, followed by personal music on mobile phones, iPods and MP3 players (13%) and Sirius XM (12%). Personal music on good-old CDs and cassettes makes up for 7%. Pureplay music streaming, downloaded podcasts and audio books are still marginal.

Canadian new car owners (usually heavy commuters) not only listen to more audio in general in the car — especially to more Sirius XM, which offers (extended) free trials — but also to more AM/FM radio in the car. Remarkable: drivers with in-dash access to on-demand audio (about 20% of all Canadians, aged 18+) say it has no impact on their in-car listening to AM/FM. “I think it’s about the fact that radio is more engaging”, Jeff Vidler assumes. “If you spend that much time in your car, you get bored from just listening to music.”

Spice your sales pitch

Radio on the Move presents commuters as ‘an affluent and attractive target’. Radio reaches 75% of all Canadians drivers each week, and 27% of all Canadian drivers or passengers spend at least 30 minutes a day commuting with a private vehicle. Of those 27%, 4 in 10 are part of the 25-54 age demo, also 4 in 10 say they have a household income of over $100,000 CAD ($77,000 USD), and 3 in 10 say that they plan to buy a new car, either this year or next year, which indicates that they are willing to spend a significant amount of money on what they want or need.

A potentially powerful argument in radio advertising sales is to show the role of radio in ‘the last mile on the path to purchase’. The report states that 82% of Canadian drivers/passengers have used their car over the last 24 hours to buy products and services. Grocery stores and shopping malls are main destinations (so stores inside a large shopping mall or plaza would always want to mention their location in a radio commercial). Other stops include banks, coffee shops (not necessarily like the ones in the Netherlands :-)), pharmacy stores and fast-food places.

Increase your positive expectation

Our industry sometimes gets bogged down by assumptions like ‘young people don’t listen to radio anymore’ or ‘podcasts are taking over radio’s role’, while this report (even if data are interpreted from a pro-radio standpoint) provides enough reasons to think optimistic of our medium. Car drivers, for example, seem to highly appreciate radio. Nearly 6 in 10 Canadians who are planning to buy a new car soon, say they wouldn’t buy it if it didn’t have an AM/FM receiver built in. Even if that sample may include many older people, it basically is good news for radio.

Being asked ‘To what extent would you miss an AM or FM radio if it wasn’t available in the next car you bought?’, it would be ‘no big deal’ to only 18% who don’t really listen to terrestrial radio in the car. About 25% would miss it, but use other sources (like satellite radio or personal collections) to compensate. Even if today’s digital natives may not be completely represented in this research (focused on Canadians of 18 years and older), there’s a solid base for radio for years to come, as a large majority (57%) answers: ‘I wouldn’t buy the car if it didn’t have an AM or FM radio’.

‘In addition to good branding, practice good meta-tagging’

Keep your station top of mind, and teach smart speakers the right skills (image: Thomas Giger)

Drive your brand ‘home’

The final segment of Radio on the Move talks about new opportunities, one of them being that more and more (Android) phones in North America now have an active FM radio chip (partly thanks to Jeff Smulyan of Emmis Communications, an active advocate of bringing radio to people’s smartphones). About 1 in 6 Canadian smartphone owners now knows that an active FM chip lets them hear radio without data charges. The report suggests that Android brands who unlock their FM chip can use it as a USP against Apple’s iPhone, which doesn’t support FM.

Smart speakers are another hot topic. We’re still in the early days, as before Christmas 2017, only 4% of all Canadian adults owned one (often a Google Home, introduced in Canada in June 2017, or an Amazon Echo, introduced there in December 2017). A great way to get into the home of listeners who don’t have (many) traditional radio devices: “Nobody has a clock radio anymore as people use their phone as an alarm, and people don’t have a kitchen radio or stereo receiver in the living room anymore”, Vidler observes.

Make your station ‘alexable’

Canadians planning to buy a smart speaker mention instant access to broadcast radio as one of their motives. It allows them to just tell Google or Alexa to play a certain station without having to manually search for it anymore. Doesn’t that make it important to frequently identify our stations again, reinforcing brand recognition and top-of-mind awareness, even in PPM markets? Is it time for more Station IDs between songs, instead of playing songs back to back, on a radio station? Jeff shares my opinion that a lot of original programming responses to PPM may have to be reconsidered:

In addition to good branding, radio stations should practice good meta-tagging to be found by smart speakers. “You want to make sure you’ve got the right terminology, so when people are searching for you, they will also find you”, he says about teaching smart speakers the necessary skills. The brand name seems to be essential: “Google Home knows me by location, so I can just say: ‘Google, please play Kiss FM’ — and even if there’s thousands of Kiss FM’s around the world, it will play the one near me.” That would also be a solution for stations that are only or mostly known by their frequency.

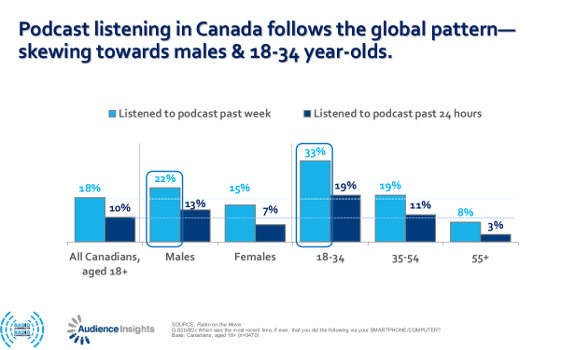

Expand your podcast library

There’s an interesting parallel between new car owners and new smart speaker owners, as both are listening to more music than they did before. Of all Canadian new smart speaker owners, more than half are listening to more music, and almost a quarter is listening to more AM/FM radio than before. For the 1 in 3 who have some kind of wireless speaker at home, those percentages are smaller, yet still significant (38% and 14%). These developments are potentially beneficial for radio’s overall Time Spent Listening.

You might want to let your on-air personalities produce a podcast apart from their daily show. Podcasting insights from Edison Research indicated a potential, now confirmed by the IAB Podcast Ad Revenue Study, which calculates that podcast revenue in the US has jumped from 69 to 119 million USD between 2015 and 2016, with a projected 85% growth to 220 million in 2017 (data not available yet). Radio on the Move’s data show that podcasts are, as in most countries, popular among men and 18-34s, but also shows that 9 in 10 podcast listeners are still tuning in to AM/FM radio.

“Take advantage of opportunities with these other platforms”

Podcast listening is mostly popular among 18-34s, indicating that radio stations for younger listeners should be active there: click to enlarge (image: Audience Insights, Radio Connects)

Turn your engagement up

Even though AM/FM radio is still the preferred medium for many audio consumers, he feels like radio can and should differentiate itself from pureplay services even more. “To be a music jukebox is perhaps limiting for the future as the Spotifies of the world are going to get better and better with playlists, so what goes on between the records is more important than ever.” While radio people often talk about on-air personality and human connection, he’s seen in research that radio listeners often mention local connection and practical information as radio’s main assets.

Jeff Vidler mentions 102.3 NOW! Radio in Edmonton, Alberta (see: Social Media Run The Radio Show) as a study case for engaging radio. “That station has really found a way to plug in to that timeline of what’s happening now. They do play music, but it’s really first about the conversation. It’s phenomenally successful; it’s been number 1 since it launched in 2010, typically with a 3 or 4 share point share lead over other stations in the market; a 13 or 14 share with the next station having an 8 or 9 share.”

Boost your tune-in factor

So how can it be that there are still so many stations who are — partly understandable, in this PPM age — actually almost like that jukebox; just playing the hits, and keeping minimum imaging & personality outside of morning drive?

“There’s a whole bunch or reasons for it. One of them is indeed Portable People Meter, which rewards stations that don’t give you a reason to tune out.” Visiting radio markets worldwide has made him see differences between how radio is developing in North America versus, for example, Europe and Australia.

“PPM rewards exposure, whereas ‘diary’ rewards engagement — remembering what you were listening to from feeling engaged with that station. It tends to favour mass-appeal radio stations that play lots of music and are very careful about managing tune-out. If you spend all your time managing tune-out, you start losing the reason why people might tune in.” Vidler explains the Edmonton success story from the fact that they make listeners keep wanting to come back to the station, which includes a certain level of engagement.

Take your brand ‘multi-platform’

Even though 18-34 year-olds still listen to a lot of AM/FM radio, new audio sources like podcasts or Spotify all have the highest usage among this demo. What are the opportunities for radio to actually benefit from this development?

“Radio stations need to explore and find ways to take advantage of opportunities with these other platforms”, he says, adding here’s a pressure on keeping costs down at the same time, especially among some larger radio companies in the US, and also a few in Canada.

“They put their energy into where they’re still making money, which is terrestrial broadcasting, rather than investing a lot of money into digital that may or may not generate returns in the short run. The question becomes: when will we get the tipping point at which putting those efforts and energies into digital is going to make sense from an accounting point of view?” He sees Canadian public broadcasters like CBC Radio, who have no shareholders, and European commercial stations such as Absolute Radio as examples of those who are ahead of the game.

“Radio is remarkably resilient”

If Liberty Media (and other companies) take over iHeart (and Cumulus) stations, it could lead to a radio rebirth in the US (image: Thomas Giger)

Grow your home audience

What do you expect to be the greatest development over the next 12 months?

“Predictions are looking at 20% of homes having smart speakers, and a lot of them having multiple smart speakers, for different rooms. It will be really interesting to see where does radio fit into that, and how it may change the game.”

Sounds like there are many new opportunities for radio!

“Yes. You do see that newspapers are in dire straits in North America; circulation and revenues have dropped over the last 10-15 years, and a decline in television advertising revenues over the last 2 years, caused by over-the-top options like Netflix. Certainly, listening to radio is not as high as 20 years ago, but it’s holding on much better.”

Reinforce your identity online

Regarding recent developments around iHeartMedia and Cumulus Media, based on their balance sheet, Jeff Vidler points out that it could make for a healthier US radio industry once other companies pick up those properties for a good price, and once there are less stations than the large number that is currently cutting up the pie (a result of the Telecom Act 1996, allowing companies to own up to 8 stations in 1 market). “A whole bunch of people went to the banks to go and buy all these radio stations, expecting to make windfalls of money, but ending up with lots of debt.”

He feels like some of the best radio in North America is actually happening on privately owned, independent stations in smaller markets. “They’re not public companies; they don’t have to worry about the next quarter profits. They’re happy getting their 15 or 20% of profit on revenues each year, so they’re willing to invest. Maybe not so much in talent, but in local service; they can spend money on digital, building local information websites and making it a key part of the business. Radio morphs and adapts. It’s remarkably resilient.”

You can learn more about the report by contacting Jeff Vidler at Audience Insights.

Header image: Thomas Giger

Add Your Comment