Commercial radio in the UK is fighting for a small piece of the advertising pie. But is putting up national brands with network programming the answer, or does it kill local radio?

Although consolidation is inevitable, local content will always remain, Global Radio CEO Stephen Miron assured at the Radio Festival 2012. Apart from that, he says, the UK’s largest radio group is investing in the future of the radio industry and in their multimedia proposition. “It’s all about getting radio onto as many devices as possible.”

“Commercial radio is a 3% medium

in advertising revenues”

Global Radio CEO Stephen Miron, here on stage with session host Emma Barnett, reveals that commercial radio stations in the UK are missing out on 97% of the total advertising budget (photo: The Radio Academy)

Build a station family

When Miron joined Global Radio in 2008 from an executive job in the newspaper business, the UK radio market was “on its knees” due to decreased advertising revenues. Back then, newspapers were still doing really good. He recalls that Global made a profit of “21 million” pounds, but was still “210 million” in debt, also because of their acquisition of both Chrysalis Radio and GCap Media. This industry-earthquake fusion of commercial radio operators created a large portfolio of radio brands for Global – which at the time of writing this article (December 2012) consists of Heart, Capital, Choice FM, Classic FM, LBC, Xfm and Gold. And if that’s not enough, Global bought former competitor GMG Radio (operator of Real Radio and Smooth Radio) in the Summer of 2012 for a sum ‘between 50 and 70 million pounds’ (source: Wikipedia). It now waits for regulatory approval of this strategic move.

Create easy-to-market, nationwide brands

Create easy-to-market, nationwide brands

“We’re very excited about it. Commercial radio is a 3% medium in advertising revenues, so there is 97% going on around us. Consolidation needs to take place for the future of the business.” Global Radio sees introducing national brands as the way to eat as much as possible of this marginal piece of the pie. It’s the main reason for the company’s nationwide rollout of London-born flagship brands Heart and Capital FM during 2011 and 2012.

Anticipate media industry changes

He calls 2006 an important turning point for the UK media industry, because of the introduction of Facebook and Twitter, and the beginning of a drop in regional newspaper ad sales – from 2½ billion then, to 1 billion now. “The game has moved on. Prior to Global coming to the market, commercial radio was in a very, very poor state of health”, Miron says. The commercial stations not only battle with each other for that 3%, but also with a strong public broadcaster: “It’s very hard to compete with the BBC, given that they spend 475 million pounds a year on programming. If you add up the whole of commercial radio, it’ll be a fraction of that figure.” He feels like the BBC is putting up Radio 1 against Capital, Radio 2 against Heart, and Radio 3 against Classic FM. He’d rather see the BBC focus on that what commercial stations cannot offer.

“It’s a natural evolution to take

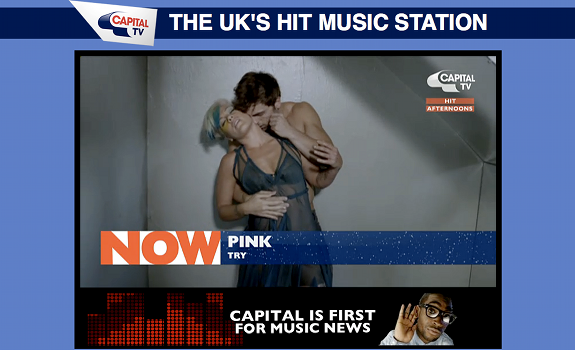

Capital and Heart onto television”

While radio is still their core business, Global has a multimedia strategy to serve advertisers and listeners through visual add-ons like their flagship brand TV channels Heart TV and Capital TV (screenshot: Capital FM)

Transform radio into multimedia

The UK commercial radio giant, which is already involved in talent and publishing as well, is clearly building more than just a radio portfolio; they believe in a complete multimedia experience. “Our audience wants to engage with our brands across many different platforms, so it’s a natural evolution to take Capital and Heart onto television.” The company has Sky Media doing their TV ad sales. “It’s just giving our advertising base [and our listeners] another platform to engage with. We’re quite confident it will pay.” For this reason, Global also looked at Channel 5 when it came to the market. “We are really ambitious as a business. Is it defined as purely radio? Obviously not. But radio is absolutely at the core of our business.”

Reach market-wide technology consensus

Reach market-wide technology consensus

Talking about investments: what about Digital Audio Broadcasting? “Nobody believes it’s going to begin happening in 2015”, Miron says, referring to the fact that in December 2012, 30% of the population was able to receive digital radio, instead of the desired 50%. A recently signed memorandum of understanding between radio stakeholders in the UK should cause a new momentum for digital. “We want DAB to happen. Uncertainty is not good for anyone.”

Stimulate radio industry growth

In Mirons view, radio has a big advantage above newspapers that have a hard time re-inventing themselves digitally. “The great thing about radio is: it’s truly ubiquitous; it sits on any platform. It’s all about getting radio onto as many devices as possible; getting out to as many people as we can.” He takes pride in “a significant amount of investment” by Global in the UK radio industry, and estimates that – including contributions from other companies – commercial radio was supported with a million pounds since 2007. “I think what we’ve brought is professionalism to the sector [and] a great product strategy, that has had a halo effect across the rest of the industry.”

“I would challenge the convention that

we’ve killed local radio”

Local editions of the Capital and Heart network feature a mix of syndicated programming and local windows, such as Heart Solent’s breakfast show with JK & Lucy – here with studio guest Robbie Williams (photo: Heart Solent)

Protect local heritage value

Some people question the scale of conglomeration and absorption of local stations by national brands, not just because heritage brands have disappeared, but also because of the cutback in employment. Apart from local morning and drivetime shows, the programming of local Capital and Heart stations comes directly from Leichester Square in London. “What would you say to those people who say that Global Radio has played a part in killing local radio?”, interviewer Emma Barnett is asking. Stephen Miron counters that the investments and changes they’ve implemented, make their brands prepared for the future of radio. “I would challenge the convention that we’ve killed local radio; we just deliver local radio differently. I would say we’re more local with the way we’re actually go about our programming.”

Read also:

- Richard Park: The Godfather of UK Radio Still Rules

- Future (related articles)

Stay tuned, follow us @RadioILOVEIT and click below to share this post:

Add Your Comment